eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

Friday, September 16, 2022

Intro to Commercial Real Estate

Thursday, September 15, 2022

Guide To Commercial Multifamily Real Estate Loans

Multifamily commercial real estate loans give investors capital that can be used for acquiring, repairing, or improving multifamily residential properties.

Loans are available for virtually all types of multifamily housing, and many loan programs have specific features that make them well-suited for certain types of housing.

If you need capital for a property, make sure you choose whichever multifamily loan is best suited for your property and the intended purpose.

Get a Free Commercial Real Estate Loan Quote

eXp Commercial Partner CommLoan - the Largest Commercial Real-Estate Lending Marketplace

[fluentform id="4"]

What is a Multifamily Property?

Multifamily properties are defined as any residential property with at least two units. Duplexes are the smallest, and there’s no limit to how large an apartment complex can be. Triplexes, quadplexes, bungalow courts, garden apartments, multistorey apartment buildings, townhouses, and high-rise condominiums and apartments are some examples of what multifamily properties can be.

In addition to being categorized by size and layout, multifamily properties can also be classified according to the demographic they serve. Standard housing, senior housing, student housing, assisted living, housing cooperatives, manufactured housing, and affordable/low-income housing are among the most common classifications used by lenders.

Mixed-use properties that combine residential units with commercial spaces can also qualify for select multifamily financing products.

Multifamily vs. Single Family

While multifamily properties technically are any properties that have two or more units, a somewhat different definition is commonly used when discussing multifamily loans.

Multifamily commercial real estate loans are generally limited to properties that have five or more units. Many of the aforementioned properties would qualify for multifamily financing, including most bungalow courts, apartments, high-rises, housing cooperatives, townhouses, and similar properties.

Duplexes, triplexes, and quadplexes might still need multifamily financing, but these properties normally don’t qualify for commercial multifamily loans. Instead, loans for properties that have 2-4 units can be obtained from personal real estate lenders. A lender or loan officer who primarily focuses on home mortgages should be able to assist with financing for these properties.

The most classic single-family property is the freestanding house. Owner-owned manufactured homes, townhouses, and condominiums are often also treated as single for the purposes of financing.

Almost all loans listed below are commercial real estate loans for properties with at least five units.

Multifamily Commercial Real Estate Loan Options

FHA Loans

The Federal Housing Administration (FHA) is a division of the Department of Housing and Urban Development (HUD). HUD is tasked with making housing affordable and equitable, and it partly does so by offering multifamily commercial real estate loans through the FHA.

FHA loans (also HUD loans) have some of the most generous terms for various affordable housing properties. In general, these loans are known for high allowed leverage rates, low-interest rates, and available long terms. Properties must meet strict criteria to qualify, but the borrower qualification requirements are lower than many other financing options.

There are several different FHA loan programs available, each of which has its own qualification requirements and benefits:

- FHA 223(f) Loans offer fixed-rate and long-term financing for existing multifamily properties. Properties must be at least 3 years old, without any significant renovations within the past 3 years. Investors may use the FHA 223(f) program as long-term primary financing on properties that will be owned for years.

- FHA 223(a)(7) Loans offer refinancing options for existing debt that multifamily properties have. Properties must currently be financed through another FHA program to qualify. Investors may use the FHA 223(a)(7) program to restructure loan terms and/or take advantage of lower interest rates.

- FHA 221(d)(4) Loans offer some of the most leveraged loan terms available for multifamily properties. Maximum terms include 90% LTV, 40-year amortization, and a 3-year interest-only introductory period. The interest-only introductory period and other terms make FHA 221(d)(4) program a good option for new multifamily construction.

- FHA 241(a) Loans offer supplemental financing for major improvements. These loans can be used to install energy-efficient infrastructure, safety features, or expand properties (in special cases).

- FHA 232/223(a)(7) Loans offer financing for senior and assisted living multifamily properties. The FHA 223 program is primarily used for primary financing, and the FHA 223(a)(7) program is for refinancing FHA 223 loans.

- FHA 242 Loans offer specialized financing for hospitals and healthcare facilities (other than assisted living facilities).

Fannie Mae Loans

Fannie Mae provides financing for low-income housing that might not otherwise qualify for commercial real estate financing.

Income requirements for Fannie Mae's commercial real estate loans are quite strict. Properties must meet one of the following criteria:

- Have 20% of units rented to families that earn less than 50% of the area median income (AMI)

- Have 40% of units rented to families that earn less than 60% of the AMI

- Have 20% of units rented through project-based housing assistance (i.e. Section 8)

Most properties that already participate in housing assistance payment (HAP), low-income housing tax credits (LITHC) or Section 8 can qualify.

For qualifying properties, Fannie Mae’s loan terms are competitive with what other lenders currently offer. Fannie Mae’s terms are especially attractive if traditional financing is unavailable, or difficult to secure.

Freddie Mac Loans

Freddie Mac underwrites real estate loans for both single-unit and multi-unit residential properties. Commercial financing for multifamily properties requires at least five units.

For multifamily properties with at least five units, Freddie Mac offers several different loan programs that afford flexibility. The agency’s programs include:

- Freddie Mac Fixed-Rate Loans offer flexible primary loan financing. The loans are available for both standard and affordable housing, and the balance, term, and leverage allowances have relatively wide ranges within which they can be adjusted. Investors may use Freddie Mac Fixed-Rate Financing as a primary mortgage on properties they intend to hold.

- Freddie Mac Floating-Rate Loans offer similarly flexible primary loan financing, but with a variable interest rate rather than a fixed interest rate. Most of these loans have terms of 10 years or less because of the variable rate, whereas fixed-rate loans sometimes go as long as 30 years. Investors may use Freddie Mac Floating-Rate Financing as a primary mortgage when interest rates are low, or for properties that will be held for a few years but not longer.

- Freddie Mac Fixed-to-Floating Loans combine a short-term variable interest rate with a longer-term fixed one, while still maintaining fairly flexible terms. These loans usually have a 9-year term (2 variable /7 fixed) but are otherwise fairly flexible. Investors might use Freddie Mac Fixed-to-Floating Financing when interest rates are low, or if they want to have more capital available for construction or rehab.

- Freddie Mac Student Housing Loans offer specialized financing for medium and large student housing apartments or townhouses.

- Freddie Mac Senior Housing Loans offer specialized financing for independent living, skilled nursing, assisted living, age-in-place, and memory care facilities.

- Freddie Mac Manufactured Housing Loans offer specialized financing for medium and large mobile home parks, or other manufactured housing communities.

- Freddie Mac Green Advantage Loans offer specialized financing for energy-efficient improvements. Investors must demonstrate that an improvement will result in a direct and substantial green improvement, and they must also commit to reducing water usage by 25%. Freddie Mac Green Advantage Financing is acquired in addition to a primary loan, and the program allows for a 5% higher LTV.

- Freddie Mac Supplemental Loans offer financing for unexpected expenses, such as major improvements or repairs.

- Freddie Mac Small Balance Loans are available for smaller multi-unit properties, including duplexes, triplexes, and quadplexes.

CMBS Loans

Commercial mortgage-backed securities (CMBS) loans are resold as an investment. Investors use them for fixed-rate returns that have low downside risk.

CMBS loans are among the most common non-government loans for commercial real estate, as they have more lenient requirements than some other private loan programs. They may be used for multifamily properties that can’t be financed via Fannie Mae or Freddie Mac, and commercial, industrial, and mixed-use properties also qualify. Loan amounts can range from as little as $1 million to as much as $1 billion.

Bridge Loans

Bridge loans provide short-term financing that “bridges” a gap. The loans are frequently used when acquiring properties or completing renovations, and almost all property types can be financed.

Most ridge loans have terms of 3-6 months. Underwriting may consider as-is value, as-stabilized value, or value-add plans. Revenues tend to be less important for these loans, as the loans are designed for purposes other than long-term financing. Buildings might not even be occupied for the entire duration of a bridge loan.

Investors may use bridge loans to finance acquisitions and renovations, or they might be used for immediate short-term flips. The latter is a somewhat uncommon use, though, because the flip must be completed within 6 months. Bridge loans have to be refinanced with another loan program whenever a property is held for longer than the loan term.

Conventional Loans

Conventional loans are a multifamily financing option if government-backed and CMBS loans aren’t available. These loans aren’t a suitable alternative for bridge loans, although banks directly underwrite both bridge and conventional loans.

Because banks directly underwrite conventional commercial real estate loans, banks themselves can determine what the lending requirements and loan terms are. Lending requirements aren’t necessarily any more relaxed than government-backed programs, and they can be slightly stricter because there isn’t a government guarantee.

The flexible terms make these loans available for virtually all multifamily properties, however, including distressed ones that might not be financed any other way.

Specific requirements and features depend on what a lender offers, and some lenders have multiple conventional financing options.

How to Get a Multifamily Loan

Financing a multifamily investment property requires evaluating all available programs, including both their eligibility requirements and loan features. Which multifamily commercial real estate loan program is best for a particular property depends on the property details, borrower qualifications, loan eligibility requirements, intended use of funds, and other details.

You can sort through all available loan options manually, or you can do so with an online multifamily loan tool.

Manually Find Multifamily Commercial Loans

While you can sort through loan options yourself, doing so is time-intensive. Only investors who are already familiar with multifamily financing tend to go this route. For instance, you might manually check loans if you already have a lender and loan program you want to use.

In rare cases, manual loan comparison might be necessary for multifamily properties with highly unique considerations.

Using an Online Loan Comparison Tool

For a more streamlined loan comparison process, use the CommLoan commercial loan finder. Simply follow the guided process, and the tool will take you through the complete process of getting quotes. At the end of the process, you’ll receive several loan quotes that can be compared. Check their eligibility requirements and terms, and apply for whichever one best suits your property and purpose.

Once you’ve chosen a quote, a lender will guide you through the remainder of the loan application process. They can help you not only apply to their institution but also apply for any government program that you’re using.

Prepare for Your Loan Application

If you haven’t already compiled these documents and figures, it’ll be helpful to know your property’s basic details, current value, expected value, building costs (if new construction or renovation), occupancy rates, and other relevant details. Additional details may be needed for specific government programs.

Lenders will also likely ask for information about your multifamily real estate investing activity. They may want to know your portfolio’s value, total outstanding loans, property revenues and expenses, ownership structure, and some other information. Your application will be considered based on the property and your current position.

Get Quotes for Multifamily Commercial Real Estate Loans

If you have an upcoming multifamily property acquisition, improvement, renovation, repair, or debt restructuring, begin the process of comparing loan options today. Some loan programs (especially government-backed ones) have longer processing time frames, so financing isn’t something you should delay. Get quotes now for multifamily commercial real estate loans, and ensure that you have enough time to obtain the best possible financing for your property.

Get a Free Commercial Real Estate Loan Quote

Fill out the form below for expert assistance from our team of Loan Consultants.

eXp Commercial Partner CommLoan - the Largest Commercial Real-Estate Lending Marketplace

[fluentform id="4"]

By submitting this form, you are confirming you are an adult 18 years or older and you agree to share your personal information with eXp Commercial and eXp Commercial partner CommLoan to use for this business request and to contact you to discuss mortgage loan products and rate options at the email address and the phone number provided including via text, automated or prerecorded means. You also agree to subscribe to stay connected to the latest updates by email and telephone.

Wednesday, September 14, 2022

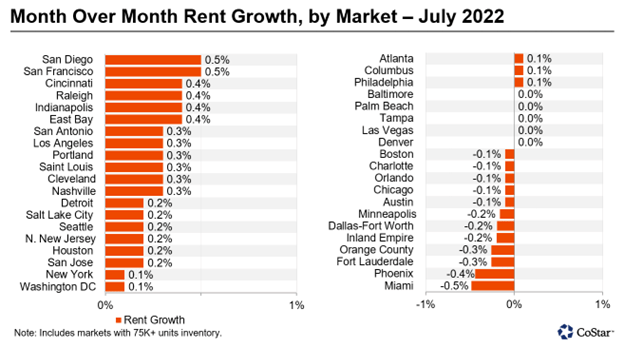

Apartments.com Publishes July 2022 Rent Growth Report

National Year-Over-Year Multifamily Rent Growth at 8.4%, Down from 9.4% in June

WASHINGTON – Today, Apartments.com – a CoStar Group company – released an in-depth report of multifamily rent growth trends for July 2022 backed by analyst observations.

“Throughout the month of July, while multifamily yearly rents continued to perform well above historical averages, the deceleration of rent growth quickened at a time when markets typically post their best results,” said Jay Lybik, National Director of Multifamily Analytics, CoStar Group. “The deteriorating rent situation highlights a significant collapse of demand in the sector when new unit deliveries are projected to hit 230,000 in the second half of 2022.”

SUNBELT MARKETS REMAIN IN TOP 10, START SEEING DRAMATIC PULLBACK

According to Apartments.com, Sunbelt cities dominated the top 10 rent growth markets in July with eight out of 10 located within the region. Florida continued boasting seemingly strong demand with four of the five top markets located in the state, including Orlando, Fla.; Miami, Fla.; Fort Lauderdale, Fla.; and Palm Beach, Fla.

However, the markets with the fastest growing rent in 2021 are now experiencing the quickest pullback. For example, Palm Beach has seen a dramatic slowing of growth with year-over-year asking rents decreasing from 30.6% in Q4 2021 to 12.7% at the end of July 2022. Tampa and Las Vegas have also seen rents retreat by over double digits so far this year. BAY AREA MARKETS BUCK DOWNWARD TREND On the flip side, the San Francisco and East Bay markets challenged the downward rent growth trend. San Francisco’s average asking rents are now just $18 below their all-time peak of $3,116 in Q2 2019 as rents rose 40 basis points over the past 30 days to 5.0%. The East Bay also held strong at 5.5% throughout the month of July. MONTH OVER MONTH DATA PAINTS A DETERIORATING RENTAL MARKET PICTURE Analysts have found that looking sequentially, 12 markets saw absolute asking rents decline over the past month, the first occurrence since 2020. Miami led the charge with average asking rents down $11 during July, in addition to five markets that reported no change in rents over the last 30 days.Tuesday, September 13, 2022

MULTIPLE REAL ESTATE SECTORS POISED TO BENEFIT FROM JULY INFLATION SLOWDOWN

Inflation trend may be turning the corner. The headline Consumer Price Index in July was up 8.5 percent compared to a year prior, a deceleration from the 9.1 percent year-over-year jump recorded in June. This slowdown was driven predominantly by a month-over-month decline in energy prices, led by a 7.7 percent drop in the gas price component of the index. The costs of other items, most notably food, continued to rise, however. Setting aside energy and food, core CPI advanced 5.9 percent year-over-year in July, matching the pace set in June but below the 6.4 percent, year-over-year increase reported in March. Stability in the core index paired with a smaller rise in the headline rate suggests that inflation may have peaked, likely a reflection of less impeded supply chains and tightening monetary policy.

Additional quantitative tightening is still on the docket. While slowing, inflation is still high, which will likely prompt the Federal Reserve to raise the overnight lending rate again in September. Next month the Fed will also double its level of balance sheet reductions to $95 billion in monthly volume. Long-term interest rates, such as the 10-year Treasury, will likely feel upward pressure as a result. The combination of elevated inflation and climbing interest rates will be a challenge for investors, however, the market has already begun to recalibrate. In some cases, prices are being adjusted or buyers are reducing leverage. Investors may also be considering new locations or asset types. Overall, the market is liquid, with investors holding favorable long-term outlooks.

Additional CRE Trends:

Multifamily outlook is largely unfazed. The impact of high inflation and rising interest rates is so far not having a substantial impact on the underlying need for housing. Demand for apartments surged in 2021, with net absorption eclipsing 650,000 units, nearly double the previous peak. That metric has been more tempered in the first half of 2022, due in part to delayed eviction proceedings, as well as limited options for prospective tenants. June’s 3.2 percent national vacancy rate was a three-decade-plus low for that time of year. Tight availability aids rent growth in the near term, while a structural housing shortage also lends strength to the outlook for the next three to seven years.Lower fuel costs boost hospitality outlook for rest of year. The energy component of CPI, which was up 43.5 percent year-over-year in June, took a notable step down last month, with prices falling across oil, gasoline, and natural gas. This shift bodes especially well for travel. Hotels have already seen increased bookings throughout the year, despite higher fuel costs. June occupancy was just above 70 percent, a pandemic-era first, even with an average daily room rate more than 15 percent above the same point in 2019, which helped compensate for higher costs. The ability to reprice rooms on a daily basis can also appeal to investors concerned about short-term cash flow during elevated inflation.

0.0% |

8.5% |

| Change in CPI from June 2022 to July 2022 | Year-over-Year change in CPI as of July 2022 |

Monday, September 12, 2022

Five Predictions That Could Revolutionize The Multifamily Housing Industry

Look around. If you're a multifamily housing investor, you've seen a steady increase in the number of condos and apartment complexes popping up everywhere. Currently, 35% of the U.S. population is renters, and that figure is rising. However, for owners and operators of multifamily communities, attracting and retaining residents will depend on the ability to integrate amenities and services that meet the expectations of today's (and tomorrow's) increasingly savvy residents. The emergence and adoption of cutting-edge technologies is just the ticket for meeting that challenge.

Here are five predictions that I believe will gain momentum and revolutionize the work and leisure lifestyles for residents as well as optimize investments for owners and operators.

1. Prepare to experience a virtual living space beyond your imagination.Virtual and augmented reality technologies are reinventing the leasing process for both agents and residents. The savings in time, effort, and costs for leasing agents are substantial. Donning lightweight AR headsets, prospective residents can tour multifamily communities online and enter a virtual world where realistic avatars walk them through floor plans and community amenities.

Digital layouts can allow renters to visualize how their existing furnishings will fit, experiencing how it would feel to actually live there. This virtual staging can eliminate on-site staging and photography costs, reducing the time, staff, and office space needed to maintain property portfolios. Strategic planning and problem-solving for properties can be done directly from the office. VR can be effective for employee training, and AR glasses in the field can enable maintenance staff to collaborate with the central office for issues and repairs. Virtual application possibilities are endless and can enhance the experience for both operators and potential residents.2. Retire your leather billfold for a crypto wallet.

Cryptocurrencies like Bitcoin are gaining wider understanding, acceptance, and use across many industries. There has been a steady climb in consumer interest and investment, particularly among Millennials.A form of potential online digital payment for goods and services, crypto relies on blockchain technology that tracks and records each transaction in a decentralized manner through a distributed ledger. Its secure data sharing and strong privacy can eliminate attempts at data manipulation. With tight security, transparent record-keeping, instant transfers, and no government controls or "middleman" fees, cryptocurrency may become an attractive option for multifamily operators as well as residents.

Some forward-thinking multifamily operators are already accepting Bitcoin for rental payments as well as offering Bitcoin rewards for positive resident behaviors and referrals. As Forbes notes: "Blockchain can make MLS property data more centralized and accessible, [with] title records easier to track and transfer." Multifamily operators would be wise to keep a watchful eye on this rising currency movement and consider the many benefits and applications. 3. Kick the traditional parking garage to the curb. Instead of vast underground lots with space(s) designated for every unit, multifamily parking in the future may look quite different. Owners might partner with car share companies for residents to use the services of electric cars only as needed. Dedicated pickup and drop-off zones would allow for the convenient use of autonomous vehicles and rideshare services. Residents with a focus on "green" initiatives already rely on public transportation and walkability factors. Bike storage, rental amenities, and other reward incentives for carless residents should attract rental applicants to properties offering these features. With less dedicated parking, multifamily owners can use the reclaimed space for amenities like halls for community activities or even shared VR rooms. 4. The knock at the door could be your bot buddy. Consumers have developed high expectations for service delivery, and technological innovations are rising to meet these demands. What once seemed like science fiction is fast becoming reality. For example, Amazon has patented blimp warehouses where AI-based drones will fly back and forth to pick up packages and deliver them to drop zones below. By early 2022, Wing—Alphabet's drone service—had already made 200,000 deliveries. In the very near future, multifamily communities could provide myriad drone and bot services to benefit residents and improve the bottom line as they deliver right to your door. With NASA working on urban air mobility maps of metro air spaces, this futuristic image of autonomous drones above and robots below is no longer far-fetched. 5. Net-zero emission designs will bring sunny days for multifamily units. The promise of lower utility bills can be a major incentive in choosing a unit. Multifamily operators are capitalizing on the benefits of cheap, clean, and renewable energy sources. According to the Net Zero Energy Coalition's latest report, multifamily living now accounts for 58% of all net-zero carbon units in the U.S. that are under construction, newly completed, or in the design phase. In California, all new multifamily housing construction must have solar panels for dwellings up to three stories.Communities sharing solar arrays, energy allocations, and credits will be distributed across multiple user accounts. Common areas converted to solar could save thousands or millions each year, and revenue from the sale of excess energy can lead to a quick ROI and future revenue growth. Most importantly, many residents should be attracted to units with cost-saving amenities and "green" initiatives.

Embrace transformation for the new multifamily paradigm. There's no crystal ball to affirm my predictions, but I'm certain these and other transformative technologies will reshape our work and leisure lifestyles—not to mention the multifamily living experience—in ways we can't even begin to imagine. Multifamily owners and operators should plan now for the future and integrate these trends in some manner over the next three to five years. Those who make the leap should gain a competitive edge. Start building community into your properties while providing the kind of cutting-edge advancements and amenities that residents are seeking. Happy long-term residents (and a healthy bottom line) should be your reward.

Sunday, September 11, 2022

Saving vs. Investing: Creating a Healthy Mix

Saving and investing are two very different financial strategies. Once you understand the difference between saving and investing, you may do a better job of managing your money. Why? You’ll have a better grasp of when it’s appropriate to save money, when it’s better to invest, and which financial products are right for each goal.

What is saving?

Saving essentially means storing your money to use in the fairly near future. You might deposit this money into a bank savings account.

What are the advantages of putting money into savings?

Saving is a good strategy if you’ll need your money in a short time. You may earn some interest on your balance, but not much.1

More important reasons to put money into savings might be that you:- Won’t lose money: In most cases, savings accounts are insured against loss by organizations like the Federal Deposit Insurance Corporation (FDIC).

- Can access your money quickly: When you need your money, you can usually withdraw it without any financial penalty up to a certain number of withdrawals per month, after which you may have to pay a fee.

What are the risks?

Your money may not earn the highest potential yield. In fact, if your savings interest rate doesn’t keep up with the average cost of living, you lose some of your money’s buying power over time.

What financial goals call for saving rather than investing?

Consider putting money into a savings-type account if you need it within in a short time. A typical market cycle is five-to-seven years, so if you need the money in less time than that, it’s a good idea to put it in a savings account. Saving is also a good strategy if you plan to completely fund the goal yourself, and don’t need to rely on your money growing significantly.

Examples of savings goals include:- Car down payment

- Vacation money

- Down payment for a home, you’ll buy in seven years or less

- Home improvement projects

What financial accounts should you consider for storing savings?

- Bank/credit union savings accounts

- Interest-earning checking accounts

- Money market accounts

- Certificates of Deposit (CDs)

- U.S. Treasury bills and savings bonds

What is investing?

When you invest, you expect to earn money on your investments over time—more than you could earn with a savings account.

Because investments, such as stocks, bonds, and mutual funds, are connected to the financial markets, your account values may go up and down according to changes in the economy.

What are the advantages of putting money into investments?

Investing is often a smart strategy for achieving longer-term financial goals. Because you won’t need your money right away, you can afford for your investments to fluctuate in value. In addition, you can:

- Give your financial goals a head start: Investing may help you earn more money in return than you could just by saving.

- Participate in global financial markets: Even if you don’t own a profitable, global business, you can share in its success. How? By buying a company’s stock or owning a mutual fund that invests in companies.

What are the risks?

Investments may climb in value when financial markets are doing well, the economy is improving, or a company’s profits are growing. However, investments can also lose money when the market declines or a company’s performance slumps. It’s possible to choose low-risk investments. However, they usually earn less over time.

What financial goals might require investing instead of saving?

Investing can be a good approach when you have longer-term financial goals or need to earn significantly more money than you could by saving it.

Consider investing for:- Retirement

- College costs

- Down payment for a house, you plan to buy in 10+ years

- Starting a business

- Leaving a financial legacy for your family

What types of financial products or assets are considered investments?

- Stocks

- Bonds

- Mutual funds

- Exchange-traded funds (ETFs)

- Real estate

- Real estate investment trusts (REITs)

A healthy mix of saving and investing

Most people benefit from both saving and investing. For instance, you might store money in a savings account for your end-of-year property tax payments or next summer’s vacation. At the same time, you might invest money you’ve earmarked for a future business opportunity and for retirement.

Saturday, September 10, 2022

Rents still going up in Naperville but rate increase amount slowing

Rents in Naperville continue to increase, though at a slower rate compared to neighboring communities, according to the most recent data from a rental tracker. But the city still has some of the highest rents in the area.

In an August report, ApartmentList.com data shows the median rent in Naperville rose 0.4% between June and July, the first time this year rent growth in the city fell below a half percent.

Naperville’s slowed rate is reflective of a national trend.

Nationwide, rents rose 1.1% over the past month, down from the 1.4% rise between May and June, the report said.

The slowdown signals the market is following its typical seasonal trend, according to ApartmentList, and renters can expect rent growth to continue to cool.

However, there are no signs that prices will actually fall in a meaningful way, meaning that American renters will continue to be burdened by historically high housing costs, according to the report.

Year-to-year growth in Naperville in July was up 9.3% compared to the national average of 12.3% over the last year.

In neighboring Lisle, median rent rose 1.4% in the past month and 11.9% in the past year, while rents increased in Aurora by 0.7% since June and 11.8% since July 2021.

Renters generally find more expensive prices in Naperville compared to other cities in the nation and the Chicago metropolitan area, according to ApartmentList.com.

Naperville’s median two-bedroom rent of $1,984 is above the national average of $1,358 and above the state average of $1,251.

The only rent that was higher in July, according to the report, was in Wheaton, where the median cost of a two-bedroom unit was $2,010.

One-bedroom units in Wheaton were the same as Naperville at $1,572.

In Aurora, the median rent is $209 less than in Naperville for a one-bedroom and $188 less for a two-bedroom, according to data from the report.

To the east, Lisle rents are $117 and $201 lower than Naperville for one- and two-bedroom units, respectively.

Commercial Real Estate Market Trends: 2025 Industry Insights

Introduction In 2025, the real estate world looks different. Warehouses are booming, retail is rebounding, and suburban office spaces are ou...

-

Just Listed: Golf Sumac Medical Offices | Des Plaines IL Price: $3,900,000 SF: 35,245 Stories: 3 Occupancy: 82.3% Cap Rate: 9.63% * Stabiliz...

-

🚨 Auction Alert 🚨 I’m excited to announce that a prime 17.25-acre residential development property at 150 Harbor Club Dr, Hobart, IN, is g...

-

🚨 Auction Alert 🚨 I’m excited to announce that a prime 17.25-acre residential development property at 150 Harbor Club Dr, Hobart, IN, is g...